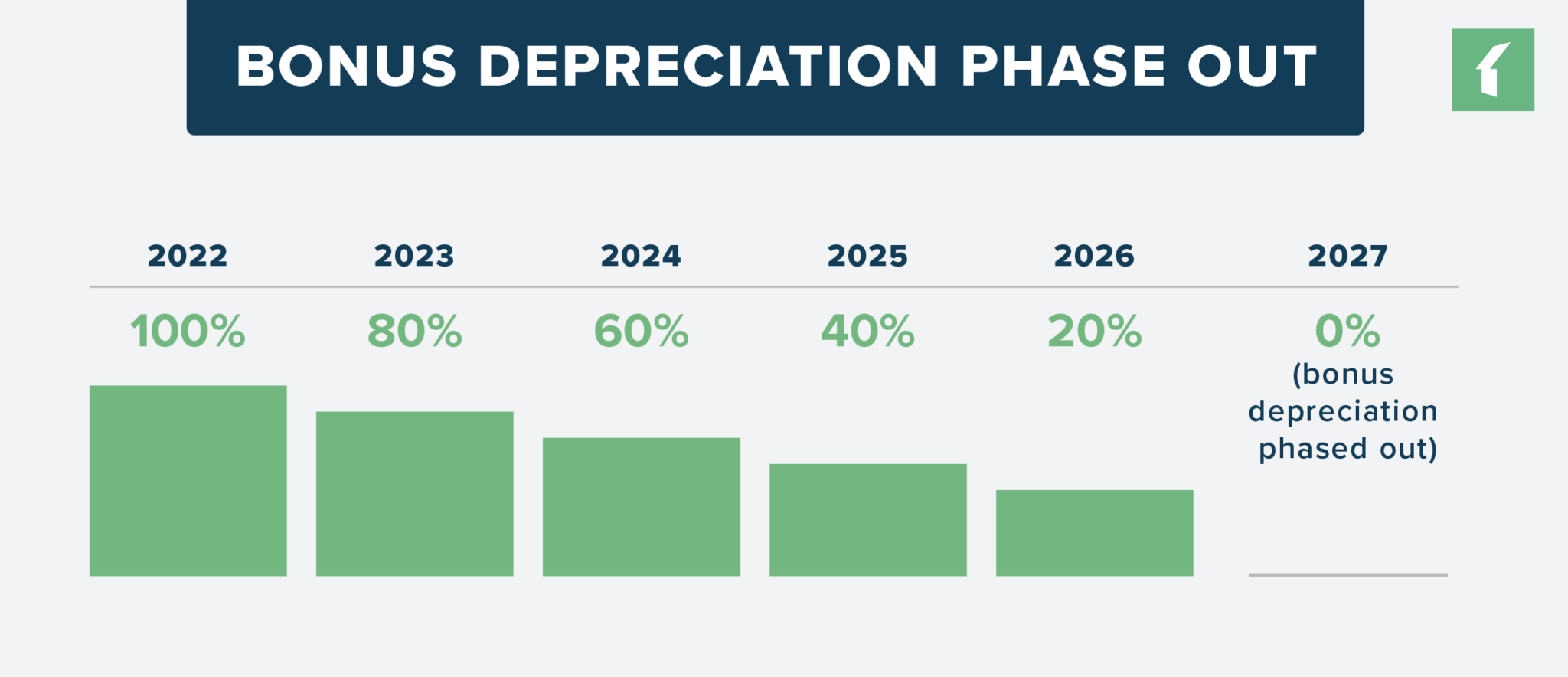

2024 Bonus Depreciation Percentage Chart

2024 Bonus Depreciation Percentage Chart. The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2024, 40% for 2025, and 20% for 2026. 80% for property entering service between 12/31/2022 and 1/1/2024.

In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn’t. Additionally, there is no business income limit, so.

In 2024, The Bonus Depreciation Rate Will Drop To 60%, Falling By 20% Per Year Thereafter Until It Is Completely Phased Out In 2027 (Assuming Congress Doesn't.

20% this schedule shows the percentage of bonus depreciation that businesses can claim for eligible assets in each year.

7024, The Tax Relief For American Families And Workers Act Of 2024, Which.

The bonus depreciation rate started its descent, decreasing by 20% annually.

The Bonus Depreciation Rate Decreased To 80% In 2023 And Will Continue To Decrease By 20% Each Year Until It Is Zero For Property Placed In Service After December.

Images References :

Source: sailsojourn.com

Source: sailsojourn.com

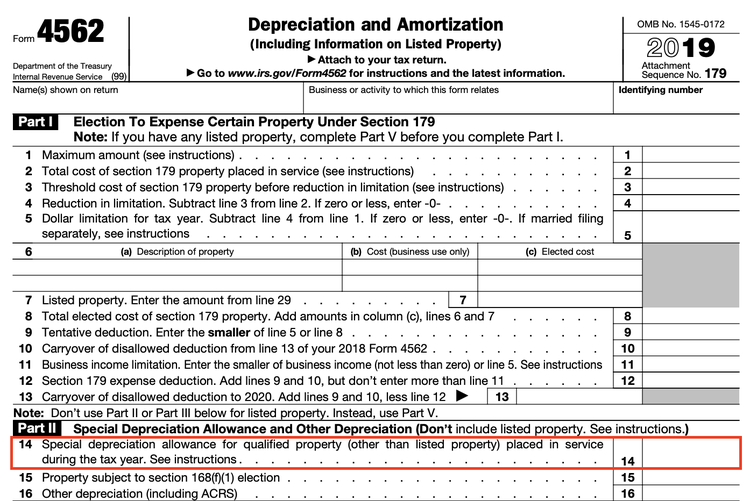

8 ways to calculate depreciation in Excel (2024), 20% this schedule shows the percentage of bonus depreciation that businesses can claim for eligible assets in each year. The full house passed late wednesday by a 357 to 70 vote h.r.

Source: www.buildium.com

Source: www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium, News april 09, 2024 at 04:14 pm share & print. 20 may, 2024 06:11 pm.

Source: www.calt.iastate.edu

Source: www.calt.iastate.edu

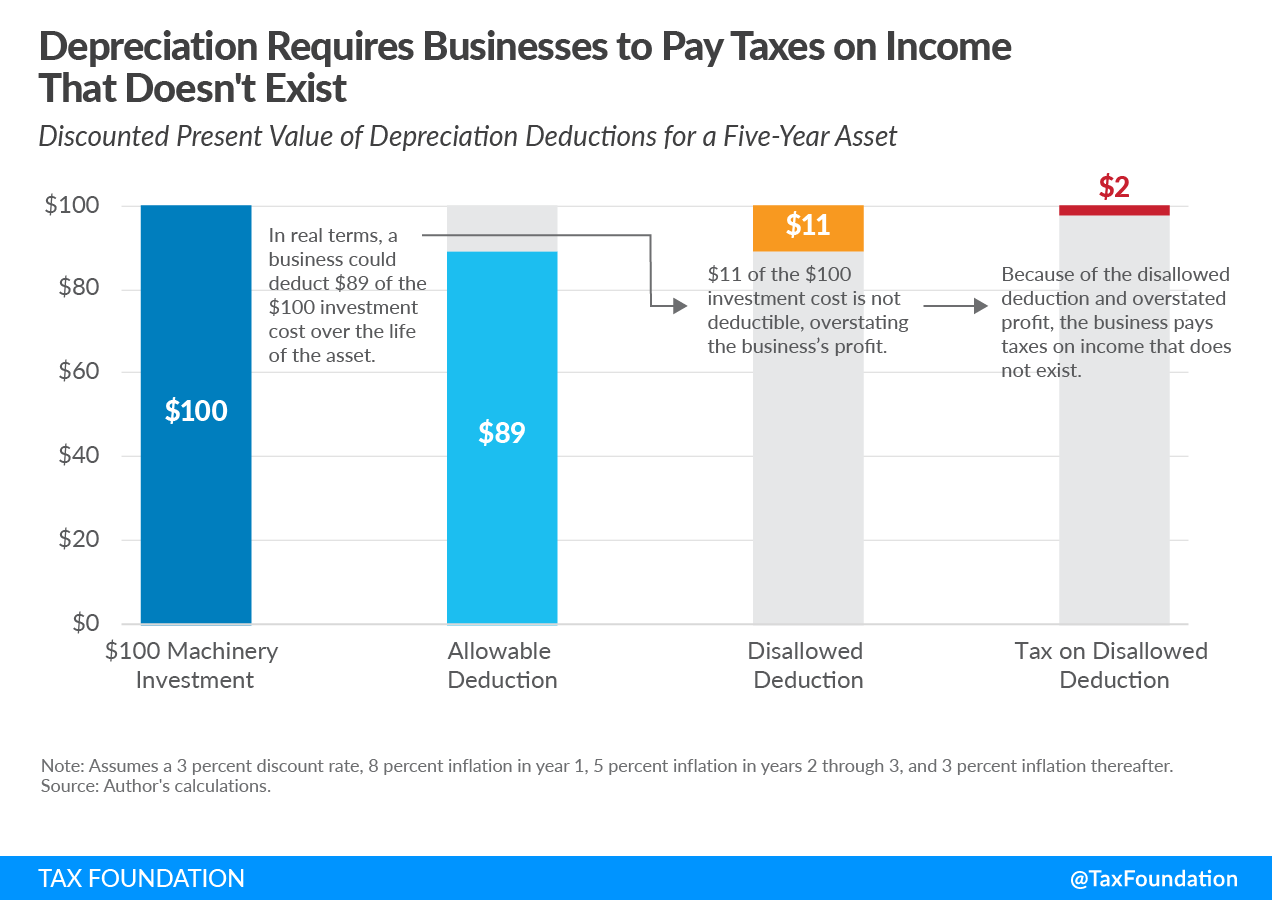

Using Percentage Tables to Calculate Depreciation Center for, Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before.

Source: taxfoundation.org

Source: taxfoundation.org

Bonus Depreciation Effects Details & Analysis Tax Foundation, 40% for property placed in service after december 31, 2024 and before january 1, 2026. This is down from 80% in 2023.

Source: ja.zpbusiness.com

Source: ja.zpbusiness.com

MACRSの減価償却表と計算方法 経理 2024, To take advantage of bonus depreciation:. The deduction will be phased down over a period of several years as follows:

Source: aeroliftusa.com

Source: aeroliftusa.com

Changes to Section 179 and Bonus Depreciation Aero Lift Inc., Qualified property eligible for bonus depreciation includes depreciable assets. In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn’t.

Source: cartriple.com

Source: cartriple.com

BMW 3 Series Depreciation How to Avoid Losing Big in 2024, Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. Qualified property eligible for bonus depreciation includes depreciable assets.

Source: www.matthews.com

Source: www.matthews.com

Bonus Depreciation Expiration, Eligible assets include depreciable personal property such as. In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn’t.

Source: mufiqvalentine.pages.dev

Source: mufiqvalentine.pages.dev

Business Vehicle Bonus Depreciation 2024 Brana Brigitte, The bill rolls back the requirement that began in. One of the allowable deductions under the income tax act is.

Source: www.lhph.com

Source: www.lhph.com

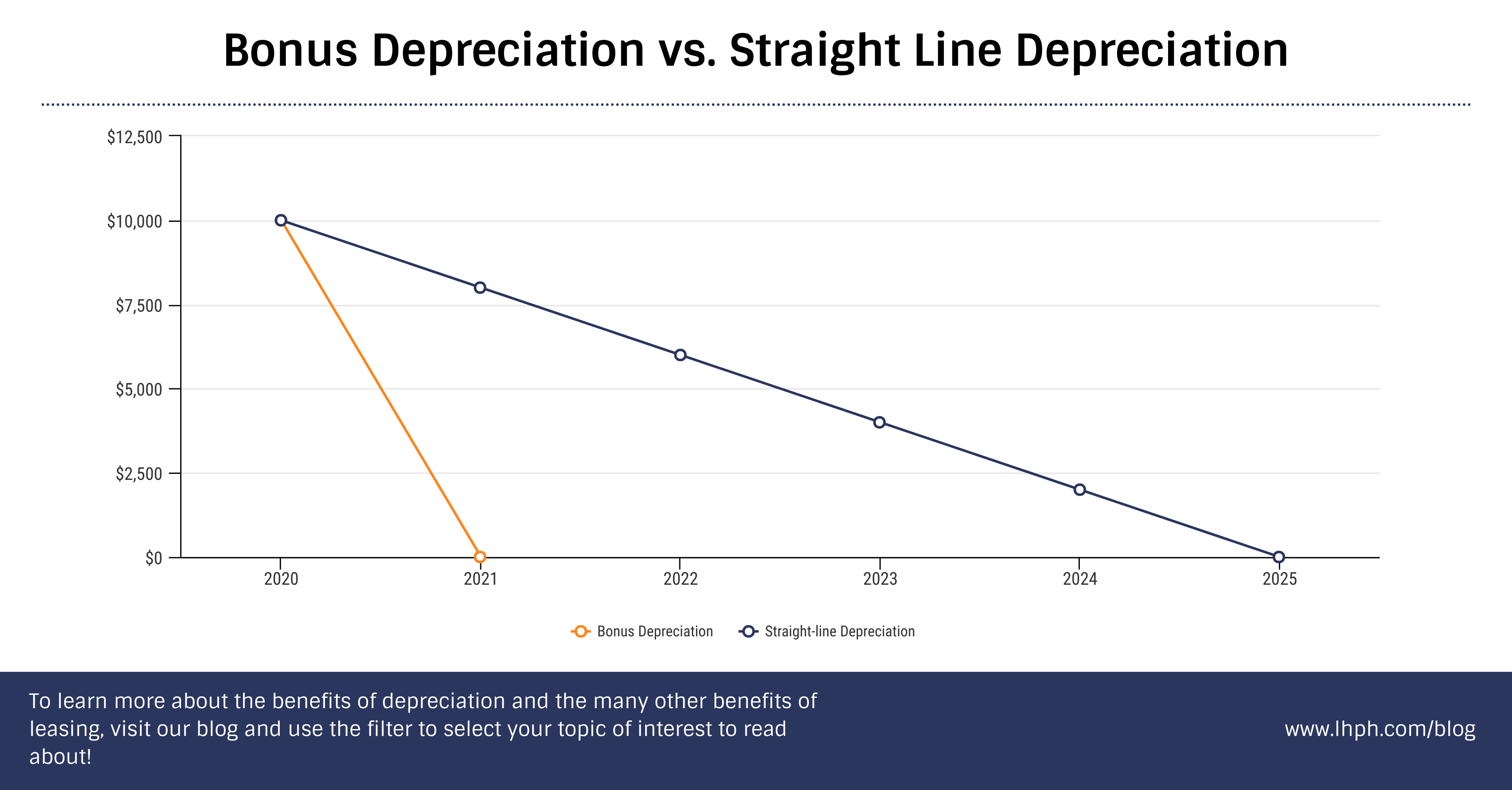

Bonus Depreciation vs. StraightLine Depreciation LHPH Capital, To take advantage of bonus depreciation:. Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024.

The Deduction Will Be Phased Down Over A Period Of Several Years As Follows:

The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2024, 40% for 2025, and 20% for 2026.

Our Free Macrs Depreciation Calculator Will Provide Your Deduction For Each Year Of The Asset’s Life.

The bonus depreciation rate started its descent, decreasing by 20% annually.